Modern companies are under tremendous pressure.

Customers want—and expect—a great product or service, amazing support, and a price that beats the competition. And, in an age of “cancel any time” and “no long-term commitments,” customers know that they have the upper hand. When companies fail to deliver, customers cancel and take their business elsewhere.

So, what should companies do to reduce cancellations and encourage long-term relationships? Let’s take a closer look at customer churn, how to calculate it, and what to do about it.

What is customer churn?

In business, the term “churn” typically refers to the act of customers cancelling, unsubscribing, or otherwise leaving. Adding up the number of customers that were lost during a specific period provides a company with its total churn metric. Churn is often tracked on an annual, quarterly, and/or monthly basis. Companies that have unusually high amounts of churn may choose to report on a weekly or daily basis, especially as they implement systems and programs aimed at reducing it.

How do you calculate customer churn rate?

Reducing customer churn is a top priority for businesses of all types—particularly those that offer monthly or annual subscription models, such as software as a service companies, no-contract wireless providers, consulting businesses on monthly retainers, and streaming media platforms. Unfortunately, improving churn is not as simple as it may seem. Customer journeys are complex and diverse. Seasonal buying patterns create artificial peaks and valleys for signups and cancellations. Just knowing what to focus on first can be a point of contention for many companies.

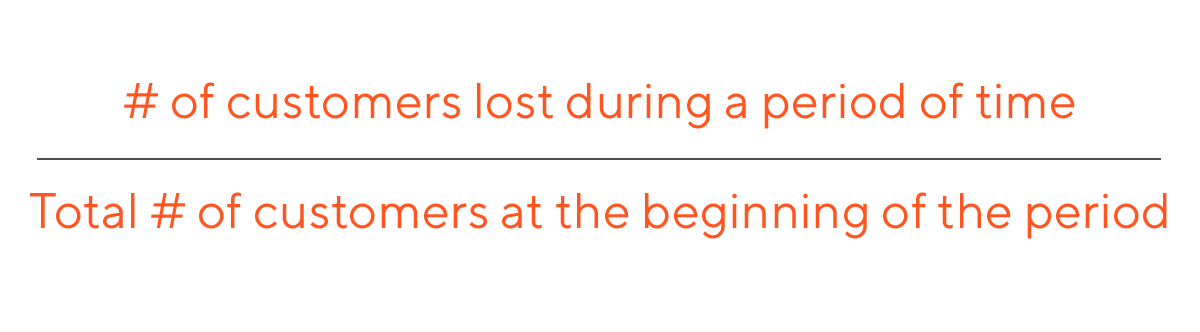

That’s why you need to normalize your churn data into a metric that accounts for the fluctuations in your business. That’s where customer churn rate comes in handy. Customer churn rate is usually calculated like this:

For a simple example, let’s assume that your company calculates churn rate on a monthly basis. On March 1, you had 1,000 total customers. By the end of March, your company lost 200 customers. This means that your monthly churn rate was 20%. Given a 20% churn rate, you could theoretically expect all of your customers to churn within a five month window. Or, stated slightly differently, your average retention period for a typical customer is five months.

5 tips for lowering churn

Maintaining a high churn rate is a recipe for disaster. There’s only so much demand generation that your sales and marketing teams can deliver. Here are five tips to consider as you develop a strategy for reducing churn.

1. Know your customers (better)

Keeping pace with customer orders and support requests can seem like an insurmountable job that leaves no time for strategic planning. However, it’s only by zooming out and seeing the big picture that your organization can identify issues that lead to cancellations. Invest more time in understanding your customers’ goals, objectives, and needs. Customer journey mapping is an excellent place to start.

2. Surround yourself with great people, systems, & processes

Does your company have the expertise and capacity to build a first-class customer success program? Perhaps you already have a qualified CS leader onboard, but he or she is in the wrong seat. Or, perhaps you need to go and recruit someone who has the right mix of experience and know-how. Start by surrounding yourself with people who are invested in the customer experience. Then, empower them to recommend and implement systems, processes, and technology that align with both your company’s and customers’ goals.

3. Focus on delivering great service & being customer-centric

An essential component of customer success is, of course, providing stellar customer service. Achieving and maintaining a one-hour response time on support tickets does not go far enough. Customers expect an amazing experience at every step of the journey—from interacting with chatbots to accessing thorough information on your support site to receiving helpful responses from your live agents.

Revisit your customer journey map and identify unnecessary points of friction. What adjustments can (and should) be made to provide a customer-centric experience? Strive to be more empathetic as a company and develop training programs that show staff how to walk in the customer’s shoes. Implement processes and metrics that hold front-line staff—particularly support agents—accountable for providing great service.

4. Collect actionable data to understand why customers leave

Customer data is more readily available now than ever before. Each customer interaction with your website, emails, and support team is another datapoint that can help you improve customer satisfaction and, hopefully, reduce churn.

If customer data management is not a strength for your company, here are a few data sources that are worth cultivating:

- Customer interviews: When a customer cancels, ask if he or she would be willing to have a 15-minute conversation. Expect a low participation rate, but also expect tremendously useful information from those who do.

- Built-in prompts: If you have a customer-facing user interface (UI), build in prompts to ask each customer why he or she is cancelling or downgrading. Sync this data directly to the contact or organization record in your CRM.

- Automated surveys: Use marketing automation technology to measure customer satisfaction throughout the entire customer journey.

These are just a few ideas to get your creative juices flowing. Collaborate with team members from support, marketing, sales, and operations and continuously look for ways to securely collect more data and improve churn.

5. Use your data to identify trends & correct course

Simply collecting large amounts of customer data is a fruitless endeavor unless you have a reliable way to track and manage it. Using an easy-to-integrate and customizable CRM, such as Insightly, makes life easier on staff when trying to make sense of customer churn data. Custom objects and fields provide flexibility for organizing data in a way that aligns with your unique business model and customer journey.

In addition, look for ways to harness data that already exists in your CRM. For example, your sales team probably tracks their lost deals and cancellations. Use your CRM’s built-in dashboards and reports to visualize this data, identify churn-related trends, anticipate problems that lead to churn, and develop new strategies for lowering it.

Build business relationships that last

At the end of the day, reducing churn is all about building business relationships that last. Companies that truly understand their customers, implement customer-centric systems and processes, and strategically use data are better positioned to build long-term, churn-resistant relationships.